A Closer Look at the Annual Kerrigan Advisers Dealer Survey: Key Takeaways

Understanding Dealership Valuation Dynamics

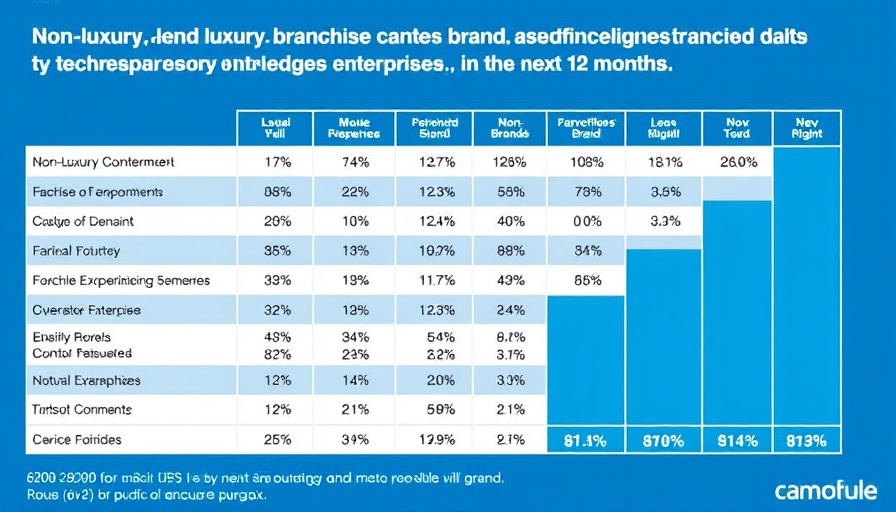

The motor vehicle dealership landscape is undergoing notable shifts in value expectations according to the recently published Kerrigan Advisers Dealer Survey for 2024. Franchise dealers are exhibiting optimism for certain brands, while voicing concerns for others. Brands like Lexus, Toyota, Honda, Kia, and Subaru are seen promising - especially Lexus, which leads in projected value gains for the first time. This shift signals confidence in these brands' market strategies and resilience.

The Survey's Revelations on Trust Levels

With trust being a critical factor in dealership success, the survey sheds light on interesting patterns. Toyota remains a paragon of reliability, boasting high trust levels from dealers— an impressive 83% trust rate, far surpassing the overall survey average. However, brands such as CDJR, Infiniti, Lincoln, and Nissan are marked by substantial dealer distrust, with CDJR showing a staggering 72% of dealers expressing 'no trust.' This distrust aligns with these brands' declining valuation expectations.

Future Predictions and Trends in Dealership Valuation

Looking ahead, dealerships project continued growth in brand values for certain franchises over the next year. However, there’s anticipation of substantial declines for others like CDJR and Nissan, which experienced a record 20% increase in negative expectations. Such insights are pivotal, enabling dealers to strategize their investments and alliance decisions, ensuring they steer toward potentially lucrative opportunities while navigating away from declining prospects.

Actionable Insights and Practical Tips for Dealerships

For dealership principals, GMs, and directors, understanding these survey insights translates into strategic decisions that could impact their bottom line. The high trust in brands such as Toyota and Lexus suggests a potential for dealerships to leverage those relationships further and focus on optimizing inventory and sales strategies to align with predicted trends.

“The ‘no trust’ levels for Stellantis, Lincoln, Infiniti, and Nissan are the highest we’ve seen since first asking this question,” highlights Erin Kerrigan, Founder and Managing Director of Kerrigan Advisors.

In light of these findings, dealerships may consider reallocating resources toward franchises that command trust and optimism, while analyzing avenues to mitigate risk associated with declining trust and profits.

Historical Context and Background: The Evolution of Brand Trust

The dynamics between dealerships and automotive brands have long been influenced by economic trends, consumer behaviors, and brand decisions. Historically, trust has been a major determinant of dealership success, impacting dealer-manufacturer relationships and, consequently, valuation expectations. The current survey data reflects shifts in this ongoing dynamic, rooted in performance metrics and market perception.

Add Row

Add Row  Add

Add

Write A Comment